Making important financial decisions requires specialist knowledge, analytical skills and experience. Searching for information on your own or relying only on the opinions of friends can lead to poor choices. Especially in the case of important life decisions and long-term commitments, such as a mortgage, it is worth using the help of a credit expert who will guide you through the entire process and take care of your interests. So when is it worth deciding to work with a mortgage expert or an online credit advisor?

Take advantage of a free consultation with an online loan expert!

Are you planning to buy your own apartment or house, but are you scared by the complicated credit process? You don’t know which offer to choose from the many available on the market? In the case of so many unknowns and concerns, it is best to use the professional support of a company specializing in mortgage loans.

What can we do for you?

- We will conduct a comprehensive analysis of your creditworthiness.

- We will present the most advantageous offers tailored to your needs and possibilities.

- We will help you through all formalities, from choosing a loan to signing the contract.

You are probably wondering how much a comprehensive credit counseling service costs? At Entremise, we receive remuneration from the bank for an efficient, effective and comprehensive credit process. We do not charge our clients any costs and do not charge them additional fees. We will take care of all the formalities so that you can focus on planning your future in a new home. With the help of our qualified financial expert, you will take out a mortgage loan on the best terms for you. Your interests are in good hands.

Take advantage of a free consultation at Entremise. Browse our entire offer ” Mortgage Loans” and contact us in a form convenient for you.

What is an online credit advisor?

An online credit advisor is a specialist who provides financial advice services via the Internet. Their main task is to help clients choose the most favorable loan, especially a mortgage, and support them throughout the process of obtaining it.

Characteristics of an online credit advisor:

- Provides financial advisory services via the Internet.

- Specializes in credit products.

- Analyzes the customer’s creditworthiness.

- Presents credit offers available on the market.

- Assists in completing documentation.

- Typically provides services free of charge to the client.

Who is an online credit expert?

An online credit expert is a highly qualified financial specialist who provides his services mainly via the Internet. His role goes beyond standard credit advice, as it includes a comprehensive analysis of the client’s financial situation and long-term planning. A mortgage expert has extensive knowledge of credit products and the current situation on the financial market.

Characteristics of an online credit expert:

- Offers comprehensive financial advice via the Internet and other forms of contact.

- He specializes in mortgage loans.

- Conducts a detailed analysis of the client’s financial situation remotely.

- Proposes long-term financial strategies.

- Effectively negotiates with banks on behalf of the client.

- Helps resolve complex credit cases.

- Often has additional certificates and professional qualifications.

- Regularly monitors changes in the financial market and legal regulations.

- It offers support both in the process of obtaining a loan and after it has been granted,

- Uses advanced online tools to analyze and compare offers.

Mortgage Advisor vs Mortgage Expert – Differences

The terms “mortgage advisor” and “mortgage expert” are often used interchangeably, but we want to highlight some differences that may influence your choice of specialist.

A credit advisor is a general term for a specialist who provides advice on various credit products, such as cash loans, consolidation loans or mortgage loans.

A mortgage expert, on the other hand, is a person who specializes specifically in real estate loans. They are characterized by in-depth knowledge of the real estate market, banking procedures related to mortgage loans, and legal aspects related to the purchase of apartments or houses. We can safely say that the work of a mortgage expert combines the features of both professions. This specialist has extensive knowledge of credit products and at the same time specializes in mortgage loans. A financial expert will provide you with comprehensive support and help you choose the best solution tailored to the individual situation of the client.

When is it worth using the services of an online credit advisor?

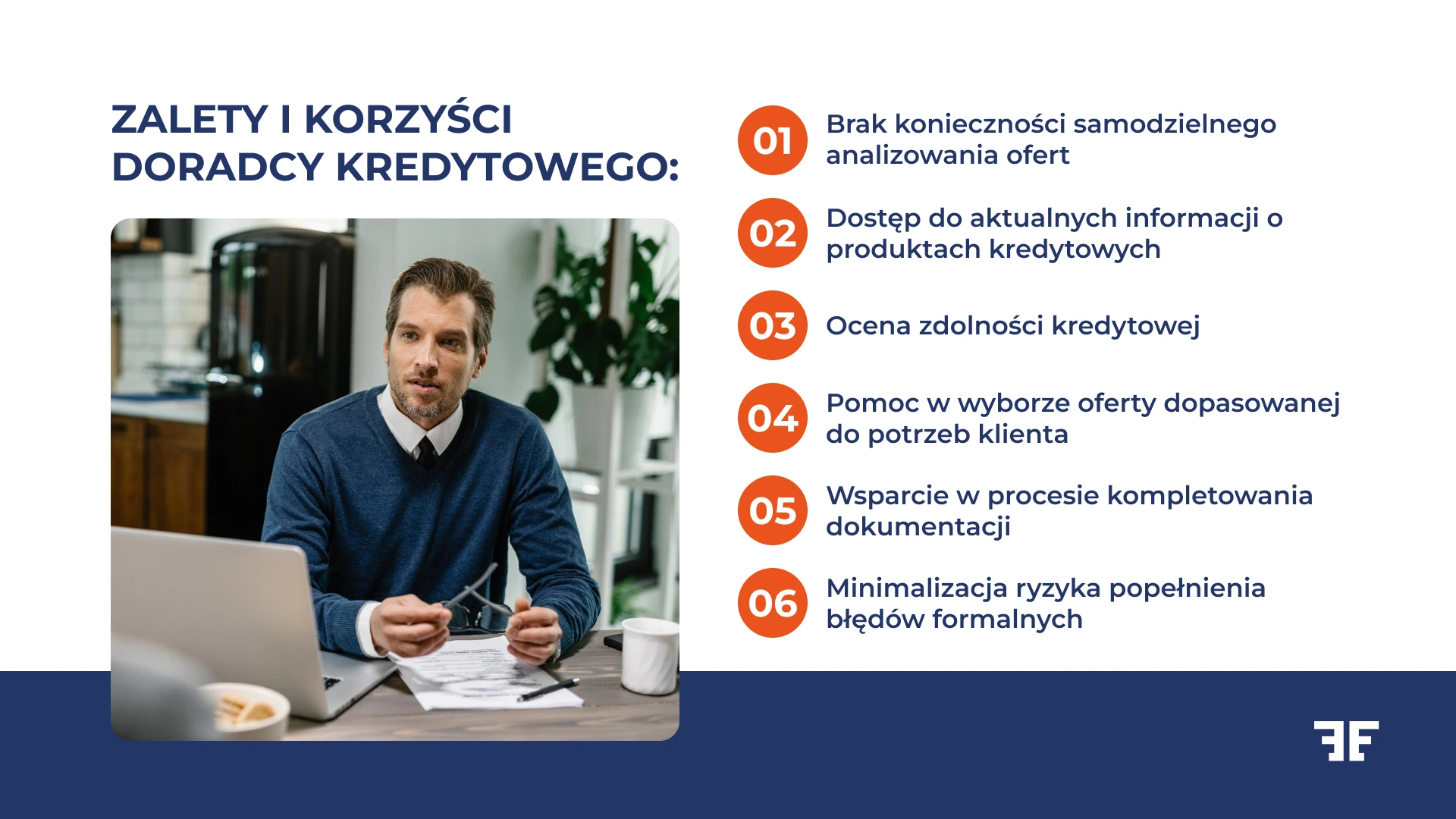

It is worth using the services of an online credit advisor, especially when planning to take out a mortgage loan. Due to the long-term nature and high amount of the obligation, professional advice can bring significant financial benefits.

An online credit advisor is also helpful when we don’t have time to compare offers from different banks on our own or when we are not sure about our own creditworthiness. It is also worth consulting an online advisor when considering refinancing an existing loan or consolidating several liabilities.

Advantages and benefits of a credit advisor

In what situations is it worth using the services of a credit expert?

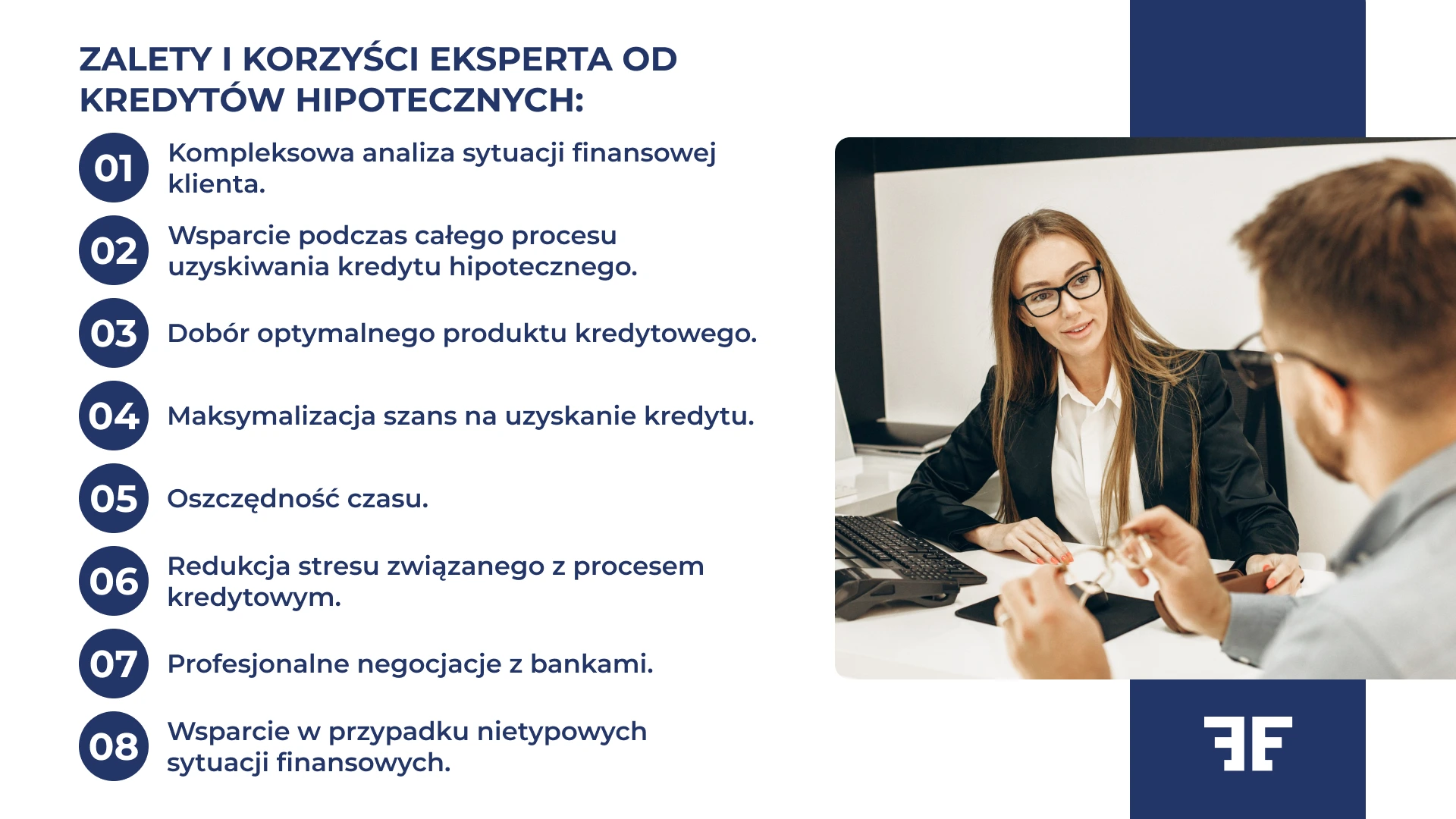

The services of a credit expert are particularly valuable when applying for a mortgage. This type of obligation is usually long-term and amounts to significant amounts, so professional support can bring measurable financial benefits. Importantly, a financial expert works comprehensively. He will help you both in choosing the most advantageous offer and in optimizing the financing structure. His professional support translates into lower installments or a shorter repayment period.

Is your situation unusual or complicated? In that case, it is also worth considering working with a financial expert. This may apply to people running a business, working abroad, or having irregular income.

Advantages and Benefits of a Mortgage Expert

Do you have any questions? We encourage you to take advantage of a free consultation with our mortgage expert. Let us help you realize your dreams of your own home or apartment. Our specialists are at your disposal to guide you through the entire credit process and help you choose the best mortgage. Contact us.

Credit expert or credit advisor – who to choose?

Our experience shows that the choice between a credit expert and a credit advisor can be of great importance for the success of the mortgage loan process. A credit expert is a specialist with a wide range of knowledge and experience, who knows the offers of various banks, is able to comprehensively assess the client’s financial situation and advise on the best solution. Their competences often go beyond just knowledge of credit products, because they also include knowledge of law, taxes and the real estate market. A credit expert is able to predict potential problems and find ways to solve them.

A credit advisor, although also knowledgeable about banking products, may have a less comprehensive approach to the entire process. Remember that their role is often limited to presenting available offers and helping you choose one.

It is also worth noting that mortgage experts often have better relationships with banks, which often translates into more effective loan negotiations or faster application processing. Therefore, if you are interested in a mortgage, it is worth considering the services of experienced mortgage experts who will provide you with comprehensive and professional support at every stage of the process.

How to Choose the Right Online Loan Expert?

First of all, pay attention to the experience and qualifications of the specialist. A good expert should have extensive knowledge of the financial market and current bank offers. Reputation is also important. Check the opinions of other customers and recommendations.

The range of services offered is also an important aspect. During a free consultation, find out if the company will provide you with comprehensive support at every stage of the credit process?

Criteria you should consider when choosing an online loan expert:

- experience and qualifications;

- reputation and customer reviews;

- range of services offered;

- availability and quality of communication;

- knowledge of current banking offers;

- the ability to tailor solutions to individual customer needs;

- transparency of operations and clear rules of cooperation.

How to check the credibility of a specialist?

One of the most effective ways is to analyze the opinions and recommendations of other customers. Look for reviews on independent internet forums or industry portals. It is also a good sign if the expert has certificates, which indicates their professionalism and continuous improvement of qualifications.

Another important aspect is the transparency of the expert’s work. A credible specialist should openly inform about their qualifications, experience and the scope of services provided. Pay attention to whether the expert is able to provide specific examples of successful implementations or references from satisfied customers. Additionally, the professional should be open and ready to provide you with detailed explanations about their work and the credit process, without avoiding difficult questions.

Entremise customer reviews

The opinions of Entremise customers are extremely positive and emphasize the professionalism and effectiveness of the services offered. Many customers appreciate the individual approach of our experts, who are able to find optimal solutions even in complicated financial situations. Customers also praise our speed of action and the comprehensiveness of services, from creditworthiness analysis to finalizing the contract.

Positive comments are particularly frequent regarding the time savings and stress associated with the credit process. Our clients emphasize that thanks to the support of Entremise experts, they were able to obtain more favorable credit terms than if they had acted alone. Many people recommend Entremise financial experts to their friends. The satisfaction of our clients and recommendations are our pride and a credible proof of the high level of services.

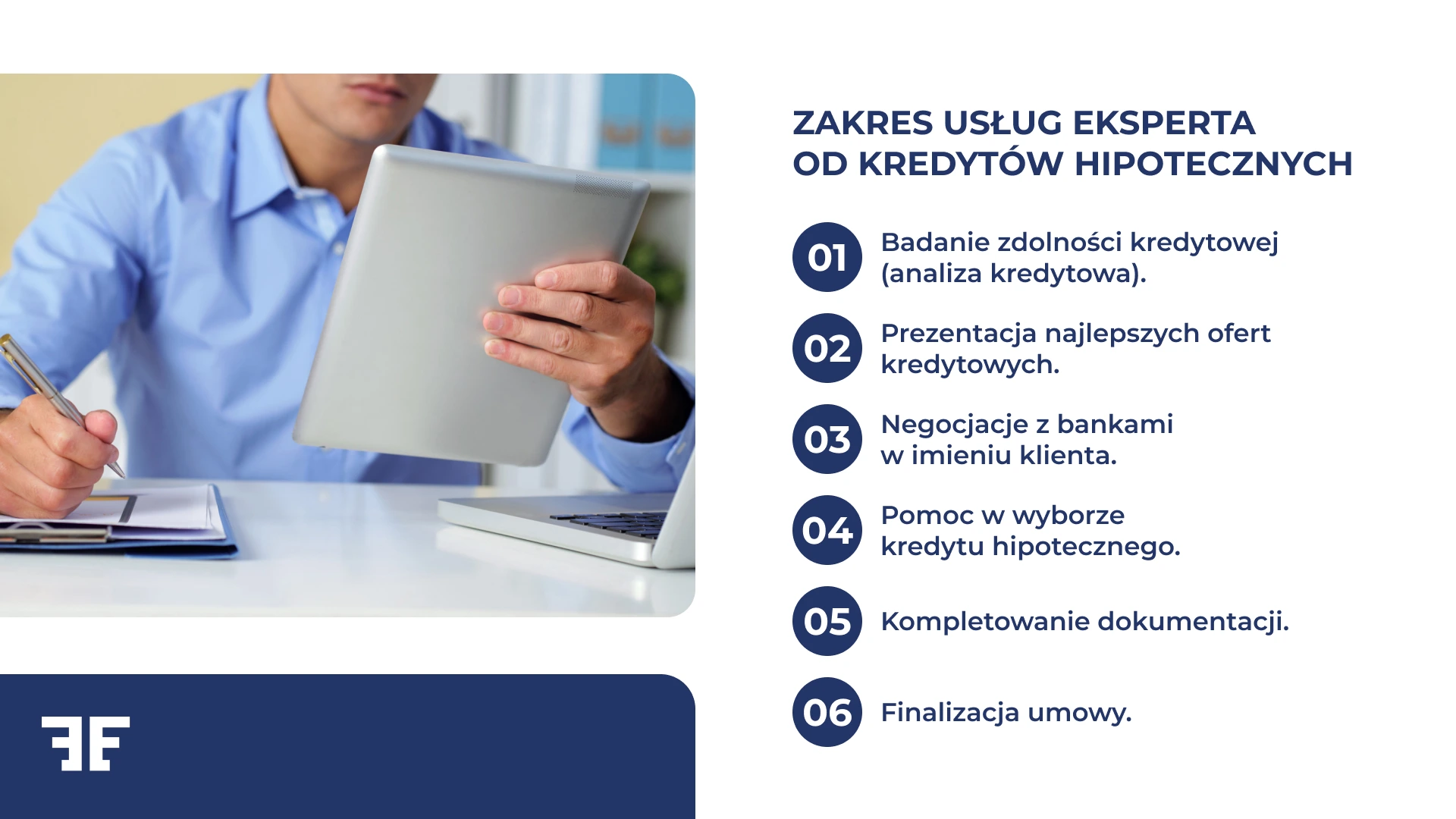

Online Credit Expert Services

Let’s take a closer look at the services offered by prestigious companies specializing in mortgage loans. The comprehensiveness of services in this area is primarily aimed at making it easier for customers to obtain a mortgage loan and guaranteeing them that it will proceed flawlessly.

The basic task is a detailed analysis of the client’s financial situation, assessment of creditworthiness and a list of the most advantageous offers available on the market. The specialist also helps in preparing the necessary documentation, negotiates terms with banks and supports the client at every stage of the credit process. Thanks to the use of modern technologies, the entire service can be carried out remotely. The possibility of starting cooperation online is a great time saver and a great convenience for the client.

Creditworthiness check (credit analysis)

The credit expert conducts a detailed analysis of the client’s financial situation, taking into account factors such as:

- income,

- obligations,

- credit history,

- employment stability.

Based on the information collected, the specialist assesses what amount of credit the client can obtain and under what conditions.

A professional credit analysis is used to accurately assess the chances of obtaining a loan and identify potential problems that could affect the bank’s decision. An expert can advise on how to improve creditworthiness, for example by repaying existing liabilities or changing the form of employment.

Presentation of the best credit offers

After conducting a creditworthiness analysis, the expert presents the client with the most favorable credit offers available on the market. The specialist has access to current offers from many banks and is able to choose those that best suit the individual needs and possibilities of the client.

The presentation of offers includes:

- basic parameters such as interest rate and installment amount,

- detailed terms of the contract,

- additional costs,

- bank requirements.

The expert explains all the intricacies and helps the client understand the differences between the individual offers, which allows them to make an informed decision.

Important information!

Remember that financial experts thanks to an extensive network of contacts and strategic partnerships with banking institutions, they have unique access to exclusive credit offers. These offers often remain beyond the reach of individual customers who apply for a loan on their own. This competitive advantage is a huge convenience for the customer, as it allows them to take advantage of more favorable financing conditions, unavailable as standard.

Negotiations with banks on behalf of the client

Negotiations with banks are the element of comprehensive services that every client counts on the most. Efficient negotiations when applying for a mortgage are a skill worth its weight in gold. Thanks to their experience and knowledge of the market, a specialist can effectively argue for more favorable conditions, such as lower interest rates, lower commissions or more flexible repayment rules.

An expert knows negotiation strategies and knows what arguments can convince a bank to make concessions. He can also use competition between banks to obtain better conditions for the client. Negotiations conducted by a professional often lead to significant savings in the total cost of credit.

Help in choosing a mortgage loan

Choosing the right mortgage is a decision that can have (and most often does) a long-term impact on the client’s financial situation. A mortgage expert helps make this decision by analyzing not only the client’s current needs but also their long-term financial goals.

The specialist explains the advantages and disadvantages of different types of mortgages, such as fixed or variable interest loans, in Polish or foreign currency. He also advises on issues such as the choice of the loan period or early repayment option. Thanks to this, the client can choose the solution that best suits their life situation and plans for the future.

Completing documentation

At this stage, the client can count on full support in collecting all necessary documents, such as income certificates, bank statements or real estate documents.

The specialist knows exactly what documents are required by individual banks and how they should be prepared. They help fill out the forms, check the correctness of the documentation and ensure that all information is consistent and complete. Their control at this stage significantly minimizes the risk of rejection of the application on formal grounds.

Finalization of the contract

The last stage of the credit process is the finalization of the agreement and the launch of the credit. Importantly, the credit expert also supports the client at this stage, helping to analyze the draft credit agreement and explaining all its provisions. The specialist draws attention to the most important issues, such as:

- early repayment terms,

- the possibility of changing the loan terms,

- consequences of possible delays in repayment.

An expert can also advise on issues related to credit insurance or choosing a bank account. And note! Their support does not end with signing the agreement. A representative of an experienced mortgage company often also offers assistance in the event of any problems or questions that may arise during the repayment of the loan. And in our opinion, this is the kind of expert you should choose.

Mortgage loan expert guarantees individual care at every stage

Do you want an individual approach and support from a personal advisor? This is understandable, because every client expects to have the support of one professional who will be 100% committed to your situation and needs when making such important life decisions and applying for a mortgage.

Working with a mortgage expert ensures individual care at every stage of the credit process. The specialist will help you choose the best offer and provide support and advice in every situation. The expert can predict potential problems and find solutions before they become an obstacle to obtaining a loan. This is a person who is an excellent forecaster and can predict the next steps of the banking institution.

Online Credit Expert – Free Consultation

Taking advantage of the opportunity to consult an online credit expert before making any financial decisions costs you nothing, and it can be an invaluable tip. During the first conversations, you can expect a professional assessment of your financial situation and knowledge of available credit options. The expert will help you better understand and implement the complex mortgage procedure and draw attention to elements that may escape the attention of a person without specialist knowledge.

Do you have questions or need help?

Maybe you want us to call you back?

Leave a contact for yourself:

You are also welcome to contact our office

Remember that making decisions about a mortgage on your own can lead to serious financial consequences. An incorrect choice most often results in higher credit costs, less favorable repayment terms, and difficulties in servicing the obligation in the future. In addition, a lack of appropriate knowledge can lead to formal errors that can delay or prevent obtaining a loan.

Need help choosing a loan? Get help from a financial expert

Get to know us better. At Entremise, we offer comprehensive credit counseling services. We specialize in mortgage loans for clients from Poland and abroad. Our financial experts have many years of knowledge and experience, and their skills translate into the ability to offer the most beneficial solutions for each client.

Thanks to our cooperation with many banks, we are able to offer you offers that are perfectly tailored to your individual needs, financial possibilities and expectations. By choosing Entremise, you gain the certainty that your financial matters are in the hands of professionals. We will take care of your financial security in the long term.