When planning to purchase a property using a mortgage, many people are initially unaware of the length and complexity of the entire process. However, when faced with mounting paperwork, those interested in a loan quickly realize that finding an attractive loan offer is only the beginning of their journey, which also includes gathering numerous documents and waiting for a credit decision.

A mortgage, is undoubtedly one of the most serious financial commitments in life. Not surprisingly, it requires the fulfillment of many, complex formalities. Proper preparation, understanding of the various steps and the support of a mortgage expert greatly facilitates the entire process. Read our detailed guide that will help you go through all the steps of getting a mortgage step by step.

Why is taking out a mortgage a complicated process?

A mortgage is a specific financial product, offered only by banks. Its essence is to provide the borrower with a certain amount of money, which can be used only for a specific purpose related to the satisfaction of housing needs. The basis of this type of loan is collateral in the form of a mortgage, i.e. an entry in the land and mortgage register of the property in question.

Characteristic features of mortgages are high amounts and long repayment periods, which can reach up to 35 years. And it is for this reason that obtaining such a loan requires meeting a number of conditions. Banks conduct a detailed analysis of the potential borrower’s financial situation, and also carefully examine the value and type of collateral offered.

The process of applying for a mortgage involves gathering extensive documentation. In addition, the terms of the agreements can vary significantly between the offers of different banks. For those making such a commitment for the first time, the entire process can seem complicated and overwhelming.

Given that the decision to take out a mortgage has a long-term impact on the household budget, it is worth considering consulting a financial expert. You can find detailed and reliable information on such a service in the dedicated“Mortgages” section of our website.

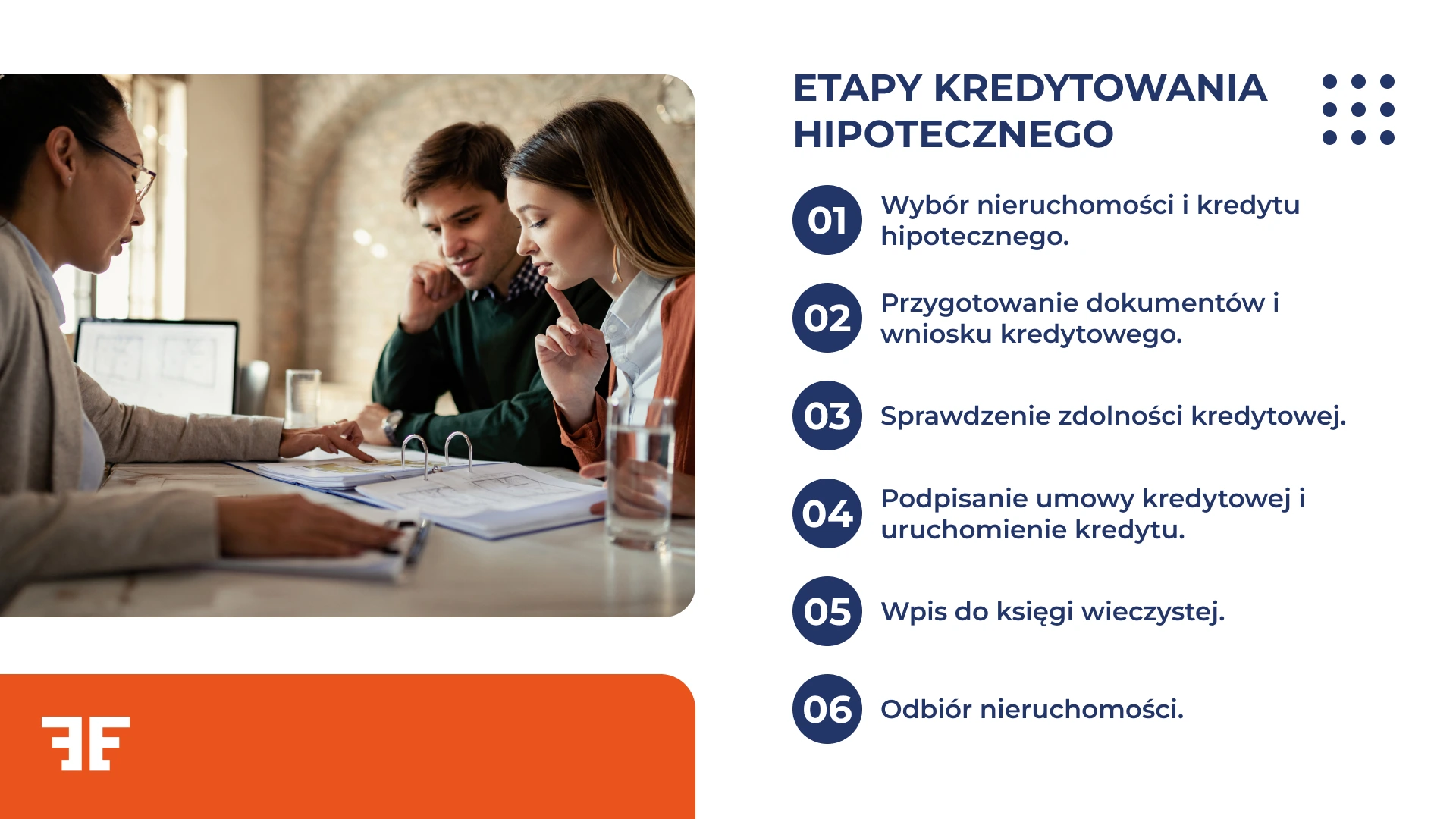

Stages of mortgage lending

The entire process of obtaining a mortgage is divided into several stages. Importantly, the borrower must go through each process smoothly and it is impossible to skip any of them. Everything begins with the selection of the property and the best loan offer, through the preparation of documents and submission of the application, to the signing of the contract and the release of funds. Each of these stages requires meticulous preparation and increased attention to secure the best financing terms. Let’s discuss each of them.

1. choice of property and mortgage

The first step in the process of obtaining a mortgage is to choose a property and a suitable loan offer. This step requires a thorough analysis of the real estate market and available bank offers. When choosing a property, you need to consider factors such as:

- location,

- technical condition,

- price relative to market value,

- investment potential.

Remember that the bank will require an appraisal of the property, which may affect the amount of the loan.

After choosing a property, the next step is to analyze the available mortgage offers. This activity is not a simple one, because if you do not want to miss anything, the best solution is to create a comprehensive summary with the most important information about the mortgage offer in each bank. When creating the analysis you should pay special attention to:

- Interest rate (fixed or variable),

- margin amount,

- mortgage loan origination fee,

- own contribution required,

- additional costs and insurance.

Developing a table with all the data and a thorough analysis of these elements will help you choose the most favorable offer. Unfortunately, we know from experience that already at this initial stage it very often turns out that those interested in a mortgage do not have enough knowledge, analytical skills or time to find all available and reliable offers, analyze them in detail and make a reliable comparison. In such a situation, we can consider the professional support of a mortgage expert as the best and safest solution.

Credit expert support

Working with a credit expert at this stage is a very interesting option. Did you know that companies like Entremise work with many banks and financial institutions? This allows them to negotiate a more favorable deal than if you went to the bank yourself for a loan. With their experience and knowledge of the market, a credit expert will help you:

- Compare offers from different banks.

- Choose the best mortgage tailored to your situation.

- Save time on doing listings and analyzing complicated offers.

- Avoid potential pitfalls in credit agreements.

Using a credit expert can make the mortgage process tremendously easier and provide you with better financing terms.

You are interested in the topic of mortgage expert. You can read more about it in: How can a financial expert help you manage your finances?

2. preparation of documents and credit application

The next step is to prepare documents and submit a credit application. To submit a credit application, you need a number of documents, including, most importantly:

- ID card,

- income certificates or PITs for the last 2 years (in the case of self-employed persons),

- Bank statements for the last 3-6 months,

- A preliminary agreement for the purchase of real estate or a reservation agreement (in the case of the primary market),

- Documents confirming ownership of the contribution.

The loan application should include the applicant’s personal information, information about income and financial obligations, details of the property to be financed, and the requested loan amount and term. Remember to accurately fill in all fields of the application and attach all required documents. Errors or omissions can significantly prolong the decision-making process.

3. credit check

The bank will carefully analyze your creditworthiness, taking into account the amount and stability of your income, current financial obligations, credit history in the Credit Information Bureau, age and family situation. Surely you know that the better your creditworthiness, the better the chance of getting a mortgage on favorable terms.

The meticulous analysis conducted by bank representatives is most often divided into 4 stages, which include preliminary, financial-personal, legal and real estate analysis.

Preliminary analysis

This stage operates in most banking institutions, but the scope of the preliminary analysis can vary from one institution to another. For example, in some banks, the preliminary decision is based on a thorough review of information by an analyst, while in others it is an automatic decision of the system after entering basic data. Most often, it includes a preliminary estimate of creditworthiness.

Remember!

The preliminary decision is not binding and does not guarantee the granting of a mortgage. It mainly serves to prescreen applications and eliminate those that clearly do not meet the basic criteria.

Financial and personal analysis

At this stage, the bank will examine your financial situation in detail, checking sources and stability of income, employment history, as well as current and future financial obligations. Also checked is your credit history in the BIK, which for many banking institutions is of great importance in assessing your creditworthiness. The bank also takes into account the borrower’s age, education, marital status and number of dependents.

Legal analysis

As part of the legal analysis, the bank verifies documents proving the applicant’s identity and legal status. Documents relating to the property, such as the title deed or preliminary agreement, are also checked. The bank also analyzes possible legal encumbrances on the property by checking its status in the land registry. The purpose of this analysis is to minimize the legal risk of the loan.

Real estate analysis

This stage focuses on assessing the value and condition of the property to be used as collateral for the loan. The bank usually commissions an independent appraiser to perform a valuation of the property. The property’s legal status, location, standard of finish and market potential are also analyzed. This detailed analysis and meticulous appraisal are confirmation to the bank that the value of the property is adequate for the amount of the loan and that it is adequate collateral for the bank.

4. signing of the loan agreement and disbursement of the loan

After the bank approves the loan application, the time comes to sign the loan agreement and start the loan. I think you will agree that these are the most anticipated stages in the process of getting a mortgage? However, even here you need to be very vigilant and maintain full professionalism – wait for the celebration until you receive your desired property.

Before signing a loan agreement carefully and several times analyze its content, paying special attention to its content:

- The amount of interest rate and margin,

- repayment schedule,

- additional fees and commissions,

- conditions for early repayment of the loan,

- consequences of late repayments.

If you have doubts, and at earlier stages you did not decide to work with a lawyer or credit expert, this is the right time to contact a mortgage specialist.

Once the mortgage contract is signed, the bank proceeds with the disbursement of the loan. At this stage follows:

- Establishment of collateral (e.g., mortgages on real estate),

- transfer of funds to a designated account (usually the seller of the property),

- start accruing interest on the loan.

Remember that the disbursement of the loan can be done in tranches, especially for loans for the construction of a house or the purchase of an apartment from a developer.

5. entry in the land register

Once the mortgage loan is disbursed, it is necessary to register the mortgage in the real estate register. The entry of the mortgage in the land registry provides security for the bank and is a prerequisite for the full disbursement of the loan.

The process includes:

- Submission of a mortgage application to the land and mortgage court,

- Waiting for the application to be processed (can take several weeks),

- Receipt of notice of entry.

6. property collection

Are you buying a property from a developer? If you are buying an apartment from a developer, be prepared for an official acceptance of the property. It involves several activities, such as inspecting the apartment for compliance with the contract and design, drawing up an acceptance protocol and reporting any defects for repair. In the case of a secondary market property, the acceptance is usually simpler and is limited to the handover of keys by the previous owner.

Conclusion of the property transfer agreement

The final step is to sign a notarial deed transferring ownership of the property. After this stage, you will be the full owner of the property. And here, finally, it’s time for celebration!

Mortgage loan – for whom?

There is no clear answer to this question, because in fact the conditions for receiving a loan vary from bank to bank. A mortgage loan is available to a wide range of people, but banks have certain requirements for potential borrowers. First of all, people with adequate creditworthiness, that is, the ability to repay the loan with interest, can apply for a mortgage. The bank’s priority is to have a stable and sufficiently high income that will allow regular payment of installments.

Banks prefer people with permanent employment contracts, but they also accept other forms of employment, including running a business. It is also important to have a positive credit history and no arrears on existing obligations.

What about the age of the borrower and his marital status? These issues also matter. The younger the person, the longer the loan term can be. Mortgage loans are available to singles as well as married couples or families, with banks taking into account the number of people in the household when assessing creditworthiness.

Tip!

Don’t forget to also take an interest in the topic of government programs that appear from time to time or are active indefinitely. There are special government programs, such as the planned “Loan to Start,” to make mortgages more accessible to young individuals and families.

The most common mistakes when applying for a mortgage loan

Applying for a mortgage is compared by some to running over hurdles. If we act on our own without the support of a lawyer or mortgage expert, there is a greater likelihood that one of the hurdles will be knocked over and we will make a mistake that can make the process of getting a mortgage much easier.

What can happen? What are the most common pitfalls and typical mistakes when buying a property and applying for a mortgage?

- Overlooking unfavorable conditions for one of the parties at the signing of the preliminary agreement.

- Underestimation of total loan costs.

- Too low a contribution.

- Not including additional fees (e.g., insurance, commissions).

- No analysis of various bank offers.

- Inaccurate completion of the credit application.

- Withholding information about financial obligations.

- No plan in case of difficulties in repaying the loan.

How to negotiate mortgage terms?

Negotiating with a bank can bring significant benefits. Prepare yourself by gathering offers from various banks. Emphasize your good credit history and stable income. Negotiate the margin, especially if you have a high deposit. Ask about the possibility of lowering or waiving commissions. Consider product packages that can lower your loan costs. Don’t be afraid to ask for better terms. Banks often have room to negotiate. Skillful negotiation can save you thousands of zlotys over the entire loan.

Negotiations in the hands of a mortgage expert

In the process of negotiating the terms of a mortgage, the help of a credit expert can prove invaluable. Specialists in this field have a wealth of knowledge about the mortgage market and extensive experience in negotiating with banks. A credit expert is familiar with the current offers of many financial institutions and can effectively compare them in terms of actual costs for the borrower.

What’s more, thanks to regular cooperation with banks, experts often have access to special offers not available to the public. Their negotiating skills, backed by their knowledge of banking procedures and current market trends, can contribute to obtaining much more favorable loan terms.

An expert will also help you properly prepare your documentation. Efficient and flawless action will speed up the decision-making process and increase your chances of a successful application. By using a credit expert, you can save money, time and the stress of negotiating with banks on your own.

Need help from a credit specialist?

Do you want to get a mortgage with the support of the best financial specialists? Wondering where to find trustworthy credit experts? At Entremise, we offer professional support at every stage of the process of getting a mortgage. We have many strengths and features that distinguish us in the financial services market. Our activities are distinguished by:

- A comprehensive analysis of the customer’s financial situation,

- Access to offers from many banks and financial institutions,

- Negotiation of favorable credit terms,

- Assistance in the preparation and verification of documents,

- Support at every stage of the credit process.

We take care of selecting the best mortgage offer, preparing a complete loan application, negotiating with banks on your behalf, monitoring the loan process until the disbursement of funds, and supporting you in optimizing the cost of the loan. Using our services is a guarantee of a professional approach and maximization of your chances of aptly choosing a mortgage offer and obtaining a positive credit decision.