Buying a home of one’s own is one of the most important life goals for many people. High real estate prices mean that most buyers must resort to a mortgage. The process of obtaining such financing may seem complicated to you, but proper preparation greatly increases your chances of a positive credit decision. We decided to make the subject a little more familiar to all those interested in an apartment mortgage. Find out how to get a mortgage, what is the amount of your own contribution and are you entitled to professional help from a mortgage expert when negotiating with banks and completing documents?

Get a free consultation with a specialist!

Before we go into a detailed discussion of the conditions for obtaining a home loan, we want to introduce you to the subject of a financial expert at the outset. Just knowing that you have the opportunity to work with a specialist is encouraging information. You do not have to go through the entire complex process of applying for a mortgage on your own.

We invite you to learn more about what Entremise offers. We are a team of experienced and passionate credit experts who help our clients through the entire process of obtaining a mortgage. We support families, couples and singles on their way to fulfilling their dreams of owning their own apartment or home.

We understand perfectly well that in such an important matter as taking out a mortgage, every decision is difficult and must be well thought out – including that of expert help, which is why we always offer a free (and no-obligation) consultation at the beginning, where:

- We will analyze your financial situation and creditworthiness;

- We will provide information on how to increase your chances of getting a loan;

- We will explain all the intricacies of the credit process;

- We will answer your questions and clear your doubts.

If you choose to work with Entremise, you can be sure that your personal credit expert will be involved from the moment of creditworthiness analysis, until the very end, which is the finalization of the contract.

Read more about it in How can a financial expert help you manage your finances?

What is a mortgage?

A mortgage is a long-term financial commitment that allows you to purchase a property without owning the full amount. The bank provides a loan for a specific housing purpose, and repayment is usually spread over 20-35 years. In this case, the loan is secured by a mortgage established on the financed property. What does this mean in practice? In case of default on repayment of the financing provided, the bank has the right to seize the property.

A mortgage loan has a lower interest rate than cash loans, but in turn requires the borrower to meet a number of conditions. The granting of a mortgage loan is preceded by a detailed verification of the customer’s documents and financial situation. The bank carefully analyzes the applicant’s creditworthiness and the value and legal status of the property. The whole process is quite complicated and consists of several stages, which you should prepare for even before choosing a specific offer and submitting an application.

Conditions for obtaining a mortgage

How to get a loan for an apartment? First of all, you must meet the conditions imposed by the bank that is to give you financial support. The most important of these are:

- Adequate creditworthiness,

- own contribution,

- positive credit history.

Banks carefully analyze the financial situation of the applicant, his employment stability and the assets he owns. Also important is the value of the property and its legal status.

Creditworthiness

Creditworthiness is the basic parameter considered when evaluating a mortgage application. It determines the ability to repay the borrowed debt with interest within the agreed period. What information is most important to the bank and what data will they analyze most carefully?

When evaluating creditworthiness, the bank takes into account such factors as:

- Source and amount of income.

- Seniority.

- Type of employment contract.

- Number of dependents.

- Savings and assets owned.

- Previous financial commitments.

- Credit history with the Credit Information Bureau (BIK).

The higher your creditworthiness, the better your chances of getting a loan and more favorable terms increase.

Mortgage contribution

An own contribution is the money a borrower must contribute from his own savings when buying a property. Currently, most banks require a minimum of 20% of the own contribution, although some accept 10% provided additional insurance is purchased. The own contribution most often comes from:

- savings,

- The sale of another property,

- donations.

The higher your own contribution, the more likely you will be able to negotiate more favorable loan terms. A larger contribution of your own funds reduces the risk for the bank, which in turn translates into lower interest rates and margins. Therefore, if you are planning to purchase an apartment in the near future, it is essential to take care first not only of a stable source of income (e.g. employment with an employment contract), but also of savings. As much as possible of your own contribution before applying for a mortgage is your bargaining chip in negotiations with banks.

Credit without a contribution? It’s possible!

We personally understand perfectly well that not everyone has the opportunity to accumulate savings or receive a donation of a significant sum from relatives. In our work, we more than once meet people who have trouble meeting this condition, but this does not mean that their chances for their own apartment are completely doomed. In such situations, it is necessary to look for other available solutions.

Some government programs, such as “Housing without a Down Payment,” offer help with the down payment for people who do not have sufficient savings. This program is aimed at people who are creditworthy, but do not have sufficient funds for the contribution required by the bank.

Positive credit history

Positive credit history, is another factor meticulously analyzed by representatives of banking institutions. Banks check an applicant’s credit history with the Credit Information Bureau (BIK) to assess his financial credibility. Is this the first time you have encountered this term?

The Credit Information Bureau (BIK) is an institution that collects and provides information on the credit history of consumers and businesses in Poland. It collects data on all credit obligations, their repayment and possible delays. The BIK is a proven source of information for banks in assessing the credit risk of potential customers.

The elements of a positive credit history are:

- Timely repayment of existing obligations,

- No default in repayments,

- Responsible use of credit products,

- long-term financial stability.

Having a positive credit history increases your chances of getting a mortgage and can contribute to better loan terms, such as a lower interest rate or a higher loan amount.

Avoid lack of credit history!

Here we want to draw attention to an issue that is very often overlooked. There is a lot of talk about negative credit history, but did you know that a lack of credit history can be just as detrimental? That’s why it’s always a good idea to take care of building a positive credit history before applying for a mortgage, such as by using a credit card responsibly or paying off smaller obligations on time.

What documents are needed to get a mortgage?

The following documents are required to obtain a mortgage:

- ID card.

- Income certificate or PITs for the last year.

- Employment contract or certificate of employment.

- Bank statements for the last 3-6 months.

- Statement of assets.

- Documents relating to the property (e.g., preliminary agreement, extract from the land register).

- Property Valuation.

- Certificates on the absence of arrears in Social Security and US (criterion for entrepreneurs).

Remember, however, that formal requirements may vary depending on the bank and the individual situation of the borrower. In some cases, the financial institution may require additional documents, such as a marriage certificate, a property separation agreement or a certificate of the amount and source of other income.

How to streamline the process of completing documents?

The process of gathering documents for a mortgage is a time-consuming and complicated stage. In many situations, the handling of paperwork significantly prolongs the entire process of obtaining financing. Many people encounter difficulties in completing all the necessary certificates and forms. It is therefore not surprising that many people, faced with increasing difficulties, decide to use the services of a credit expert.

A qualified loan specialist will help you gather the required documents and provide comprehensive support at every stage of the loan process. This will save you time and avoid potential mistakes that could delay or complicate obtaining a mortgage.

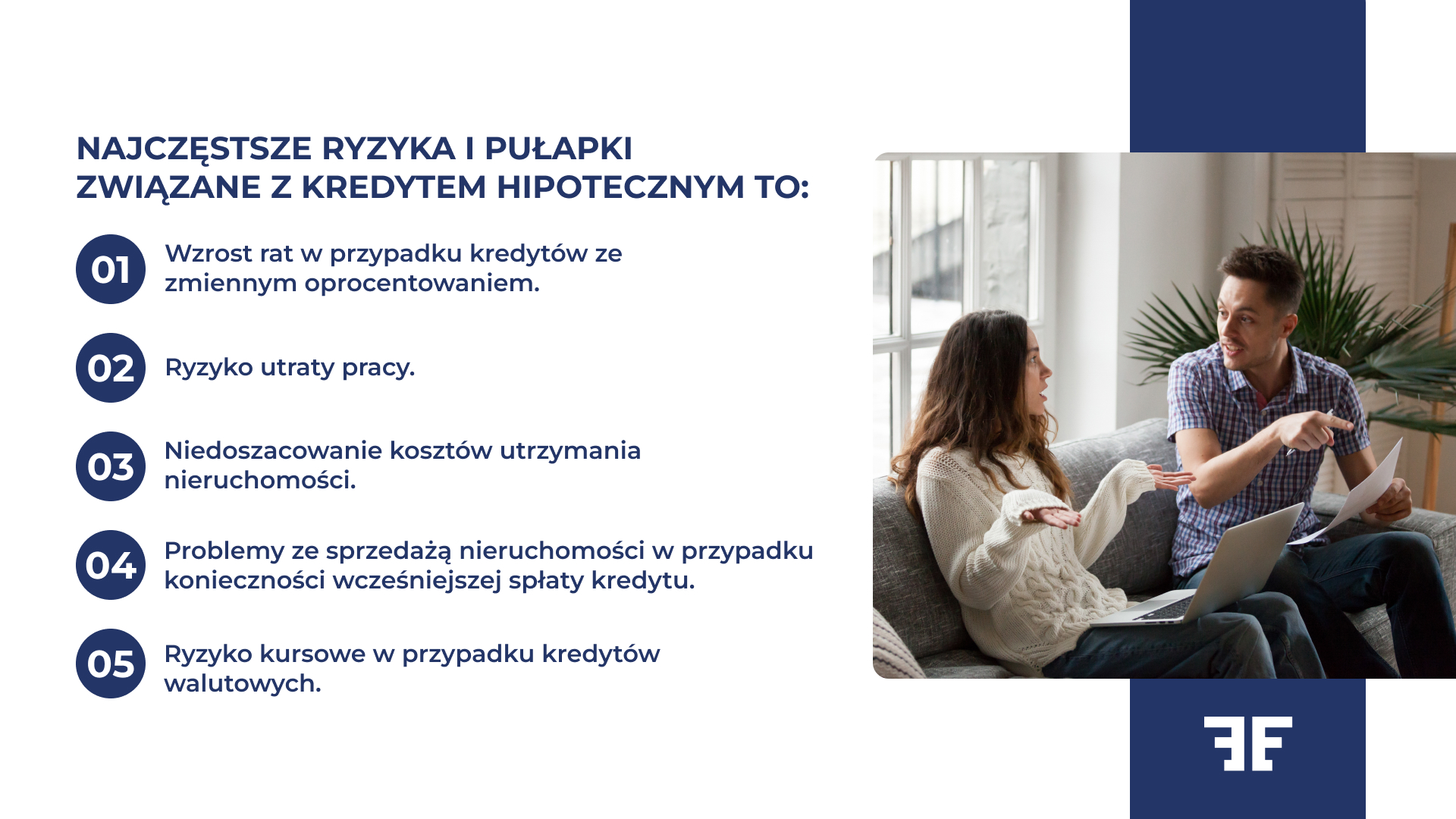

Mortgage risks

When taking out a mortgage, you need to be aware of the risks involved. First of all, it is a long-term commitment that can affect your financial situation for many years. A variable interest rate carries the risk that your installments will increase if interest rates rise. There is also always the risk of losing your job or your ability to repay the loan for other reasons. When deciding on a mortgage, you should approach the subject sensibly and with responsibility. That’s why it’s a good idea to be prepared for a variety of situations and have a plan B in place to effectively deal with a problem should it arise.

Keep in mind that only when the obligation is paid in full will you be able to feel the full satisfaction of owning your own property unencumbered.

Mortgage refinancing

Refinancing a mortgage involves taking out a new loan to pay off an existing obligation. The main purpose of refinancing is to obtain more favorable terms, such as lower interest rates, a longer repayment period or a change in the currency of the loan. This can lead to lower monthly installments and the total cost of the loan.

Our advice? Don’t make the decision to take out a new loan too hastily. The decision to refinance should be preceded by a thorough analysis of the costs and potential benefits. The main things to consider should be:

- The cost of early repayment of the current loan,

- commissions for granting new,

- Costs associated with the reassessment of the property,

- Costs behind the establishment of a new mortgage.

Refinancing can be particularly profitable when interest rates have fallen significantly or our creditworthiness has improved since the original commitment.

Costs associated with the mortgage

You would certainly like to know the total cost of your mortgage. You need to consider that it includes not only principal and interest payments, but also a number of additional fees. Among the most important costs are:

- loan origination fee,

- Bank margin,

- property insurance,

- Borrower’s life insurance,

- Real estate appraisal fees,

- Notary and court costs associated with the establishment of the mortgage,

- early loan repayment fees,

- Bridge insurance (until the mortgage is recorded).

The annual percentage rate of charge (APR) takes into account all the costs of the loan and allows you to compare offers from different banks.

How to choose a mortgage?

It is necessary to pay attention to several aspects. First of all, the interest rate on the loan is important, which can be fixed or variable. It is also necessary to compare the banks’ margins, credit commission and other additional fees. Also important is the term of the loan and its impact on the amount of monthly installments.

We recommend that you analyze various offers in terms of the total cost of the loan. Pay attention to the terms of early repayment, the possibility of suspending installments or insurance offered by the bank. It is also important that the loan is tailored to our financial situation and future plans.

You will admit that this information to check is really a lot. Those interested in a loan have to spend a lot of time reviewing offers and doing a detailed analysis. This is a big challenge for many and activities that require the help of a mortgage specialist.

Choosing the best loan for housing with the support of an expert

If you don’t feel confident or don’t have enough time and patience to analyze all the available loan offers or government programs, the best (and for that, effective) solution is to start working with a financial expert. A specialist will help you compare offers from different banks, explain the intricacies of loan agreements and help you choose the most favorable solution.

In addition, some companies specializing in mortgages have contacts with banks and thus access to offers that may not be available to those seeking financing on their own. It is worthwhile for such a specialist to represent your interests in negotiations, as he can win better terms for you, such as a lower margin or no commission.

Is a mortgage for me?

The decision to take out a mortgage should be preceded by a careful analysis of your own financial situation and future plans. A mortgage is a long-term commitment that will affect your finances for a long time. Before the final decision, carefully analyze whether you can afford to make regular installments, also taking into account potential changes in your life situation.

Consider more than just the amount of loan installments. Look at costs holistically, taking into account the cost of maintaining the property, taxes and possible renovations. In our opinion, it is also important (if possible) to have some financial safety cushion in case of unforeseen circumstances.

If:

- You have a stable source of income,

- You have savings for your own contribution,

- your creditworthiness allows you to comfortably repay the installments,

- You plan to have a long-term relationship with the location,

- you are ready for the responsibility associated with owning your own property,

that means you can (and even should) start applying for a mortgage to buy your coveted apartment.

If you need help – contact Entremise!

How to get a loan for an apartment? Get help from a financial expert from Entremise. Save your time and minimize the stress of applying for a loan yourself. Our specialists:

- They will prepare a set of required documents for you,

- They will represent you in your dealings with banks,

- Negotiate the best possible loan terms,

- They will take care of all the paperwork,

- They will support you at every stage of the process.

Entremise is a guarantee of security, peace of mind, satisfaction and completion of the loan process successfully. We can help you get a family home loan or a mortgage for a single. We are open to your needs and expectations of a credit expert. Contact us.