A financial expert is a specialist who guides a client through the complexities of the financial market. When purchasing your first apartment, house, building plot or property for further investment, the professional support of a financial expert can prove invaluable. A financial expert provides up-to-date knowledge on loans and investments and helps create a comprehensive financial plan tailored to the client’s individual needs and life situation. This comprehensiveness of activities undoubtedly speaks in favor of choosing his services.

Who is a financial expert?

The work of a financial expert involves providing comprehensive assistance to clients in making informed decisions about their finances. However, the definition of a financial expert is much longer. It is worth knowing that its role goes far beyond standard assistance in choosing the best loan offer. A financial expert analyzes the client’s overall financial situation, taking into account their income, expenses, assets and liabilities. Thanks to ongoing cooperation with banks, this specialist is able to precisely determine credit possibilities depending on the client’s financial situation, age or even the type of property.

The credit terms and the structure of the agreement itself contain many provisions that are very often not fully understood by the borrower. A mortgage expert, thanks to their extensive knowledge and experience, can help explain the legal complexities and unclear parts of the agreement. This is a person who introduces the client to the specifics and mechanism of mortgage loans, and then helps understand, choose and obtain the best credit offer.

Moreover, a financial expert is up to date with current market trends and changes in regulations. Thanks to this, the client can be sure that he or she has been presented with the most up-to-date and advantageous financial solutions.

Financial Expert | Entremise Offer

Entremise is a renowned company specializing in mortgage loans. Through our work, commitment, individual approach and professionalism we have earned the trust of our clients and their recommendations.

We successfully cooperate with a wide range of banks and financial institutions. The wide range of our capabilities ensures that we find optimal solutions for each client. Our experts are always up to date with the latest offers and market trends. Our clients have access to the best possible financial options.

The Entremise offer includes:

- Comprehensive support in the matter of a mortgage loan – Analysis of the client’s financial situation and selection of the best credit offer.

- Assistance in preparing documentation – Support in completing and filling out all necessary documents.

- Negotiations with banks – Using experience and relationships with banks to obtain the most favorable conditions.

- Credit process monitoring – Supervision of the entire process from submitting the application to loan disbursement.

- After-sales support – Customer support even after the transaction is completed.

Are you interested in our offer? Check the details of cooperation with the mortgage expert Entremise: mortgage loan offer.

How can a financial expert help in the area of mortgage loans?

- Credit Analysis – A thorough examination of your financial situation and a credit score to determine the maximum amount of credit you can count on.

- Consulting on other financial products – Helping you understand how other liabilities, such as cash loans or credit cards, may affect your creditworthiness when applying for a mortgage.

- Comparison of bank offers – Comparison and analysis of the offers of various financial institutions to find the most favorable credit terms.

- Negotiations with banks – Using your experience and relationships with banks to obtain better loan terms, such as lower interest rates or lower commission.

- Assistance in preparing documentation – Support in completing and correctly filling out all necessary documents required by the bank.

- Professional advice on your own contribution – Help in determining the optimal amount of your own contribution and finding the best way to finance it.

- Credit Risk Analysis – Explanation of all aspects of concluding a credit agreement, including potential risks and ways to minimize them.

- Support in the application process – Guiding you through the entire loan application process, from preparation to submission at a bank branch.

- Supervision of the credit process – monitoring the entire process from submitting the application to loan disbursement, including assistance in resolving any problems.

- Expert advice on additional products – Help in selecting appropriate insurance related to a mortgage loan.

- After-sales support – Help if you wish to refinance your loan or change its terms in the future.

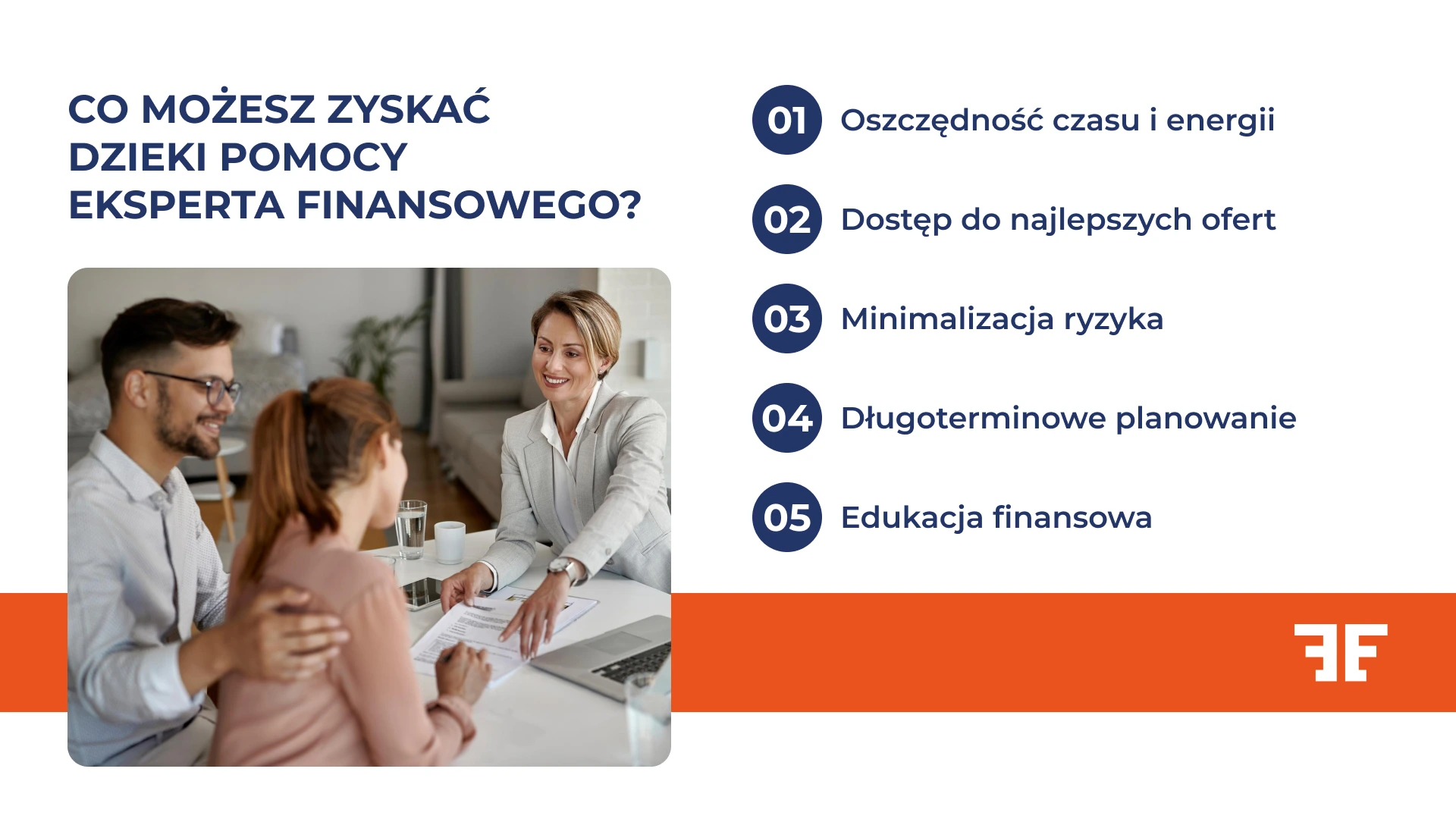

What can you gain from the help of a financial expert?

The benefits of using the support of a mortgage expert are many, but on one condition – you must choose a reputable brand that has many years of experience, prestige, an impeccable reputation and success on the market.

Saving time and energy

In the case of mortgages, the entire process begins with going through all the available mortgage offers. Let’s assume you undertake this action on your own. First, you need to carefully analyze each offer and make a comparison. It is also necessary to familiarize yourself with the terms and conditions and study the terminology used in the offers. You finally manage to do so, but unfortunately you discover that some of the offers are no longer valid.

By using the services of a financial expert, you save valuable time that you would have to spend analyzing all these offers and delving into the financial intricacies yourself. Thanks to specialized tools and experience, the expert will do it for you faster and more effectively.

Access to the best offers

Financial experts have access to a whole range of financial products that, interestingly, may not be available to the average consumer. They can find offers that are perfectly suited to your situation, and often with better terms than those publicly available.

Wondering how this is possible? Well-respected mortgage experts have direct contacts with banks, which allows them to negotiate better loan terms. And thanks to this, you have a chance to get a lower interest rate, lower commission or additional benefits that are not standardly offered to individual customers.

Before you seek help from a financial expert, you can use our intuitive calculator to calculate the loan amount and installment.

Risk minimization

With a financial expert by your side, you can avoid costly financial mistakes. A specialist will help you understand all aspects of the financial decisions you are making, draw your attention to the hidden costs of credit and potential pitfalls in credit agreements that you may not notice on your own.

A specialist will help you assess whether a given loan offer is suitable for your financial situation in the long term, taking into account both current conditions and potential changes in the future.

Long term planning

A financial expert will help you create a comprehensive plan that takes into account your current needs and long-term goals. In addition to the mortgage itself, it will take into account other aspects of your financial situation, such as savings, investments and insurance. You will receive a coherent financial strategy.

Financial education

Working with a credit expert also means valuable learning and a lot of specialist knowledge that will certainly be useful in the future. By understanding the mechanisms of finance, you will be able to make more informed, safer and more profitable decisions in the future.

How much does the help of a financial expert cost?

Let’s move on to the most frequently asked question and the issue that worries customers. How much will you ultimately pay for the help of a financial expert? How much will you ultimately pay for the help of a financial expert?

One of the greatest benefits of using the services of a financial expert is that for you as the client, the service is completely free.

Financial experts, including specialists from Entremise, receive remuneration in the form of a commission from the banks or financial institutions with which you ultimately conclude an agreement. This commission is only paid once the process has been successfully completed, for example when a mortgage loan is disbursed.

Importantly, the fact that the expert receives a commission from the bank does not negatively affect the terms you receive as a client. On the contrary. We remind you that thanks to the experience and relationships of an expert with banks, there is a good chance that you will obtain better conditions than if you negotiated with the bank on your own. A financial expert works in your best interest and always tries to find the best solution tailored to your situation, without charging you additional costs.

Is there a catch to all this? No! In accordance with the law, the services provided by a financial expert are free of charge for the future borrower.

Customer reviews

Satisfied customers are the best business card of every financial expert. Positive opinions and recommendations from people who have used the services of a specialist are an invaluable source of information for potential new clients. Therefore, it is important for people satisfied with the help of an expert to share their experiences through opinions on social media and platforms (e.g. Facebook, Google or LinkedIn).

By reading reviews from other customers, you can gain valuable insight into the quality of services offered by a financial expert. Pay attention to comments regarding professionalism, effectiveness in solving problems, and level of communication.

See what our customers say about us. Check out reviews about Entremise.

Take advantage of the Entremise offer!

By choosing Entremise you can be sure that you will find the best mortgage specialist. We have managed to assemble a team of highly qualified experts who have complete knowledge of the real estate market and mortgage products. Thanks to this, we can offer our clients (including you) the best solutions for financing the purchase of real estate.

We work with a variety of cases, from simple home loans to more complex transactions. This versatility means we can effectively help both first-time homebuyers and experienced investors seeking financing for their multi-property projects. We encourage you to request a free consultation.