Many people mistakenly believe that a home loan for a single is hard to get. There is a perception that banks prefer couples and families with children. This is absolutely not true. A single has the same chances of getting a mortgage as other applicants. In this case, creditworthiness and own contribution, not marital status, prevail. With proper preparation, a single can find a very favorable loan offer on the market. Credit for singles is also available to you.

Is a mortgage for a single person possible?

A mortgage for a single is as accessible and obtainable as possible. Banks do not discriminate against single people and offer them equally attractive products as couples or families. So, if you are a single who wonders whether a loan for a single-person household is possible and whether the interest rate on the loan will discourage you from making this decision, you need to know that you too have a good chance of getting a favorable loan from a bank.

In the case of a single, what matters is the applicant’s creditworthiness, not his marital status. A single with a good income and stable employment should without much trouble get a mortgage on attractive terms. Banks primarily evaluate the potential borrower’s ability to repay the obligation. Relationship status or marital status are therefore no obstacle.

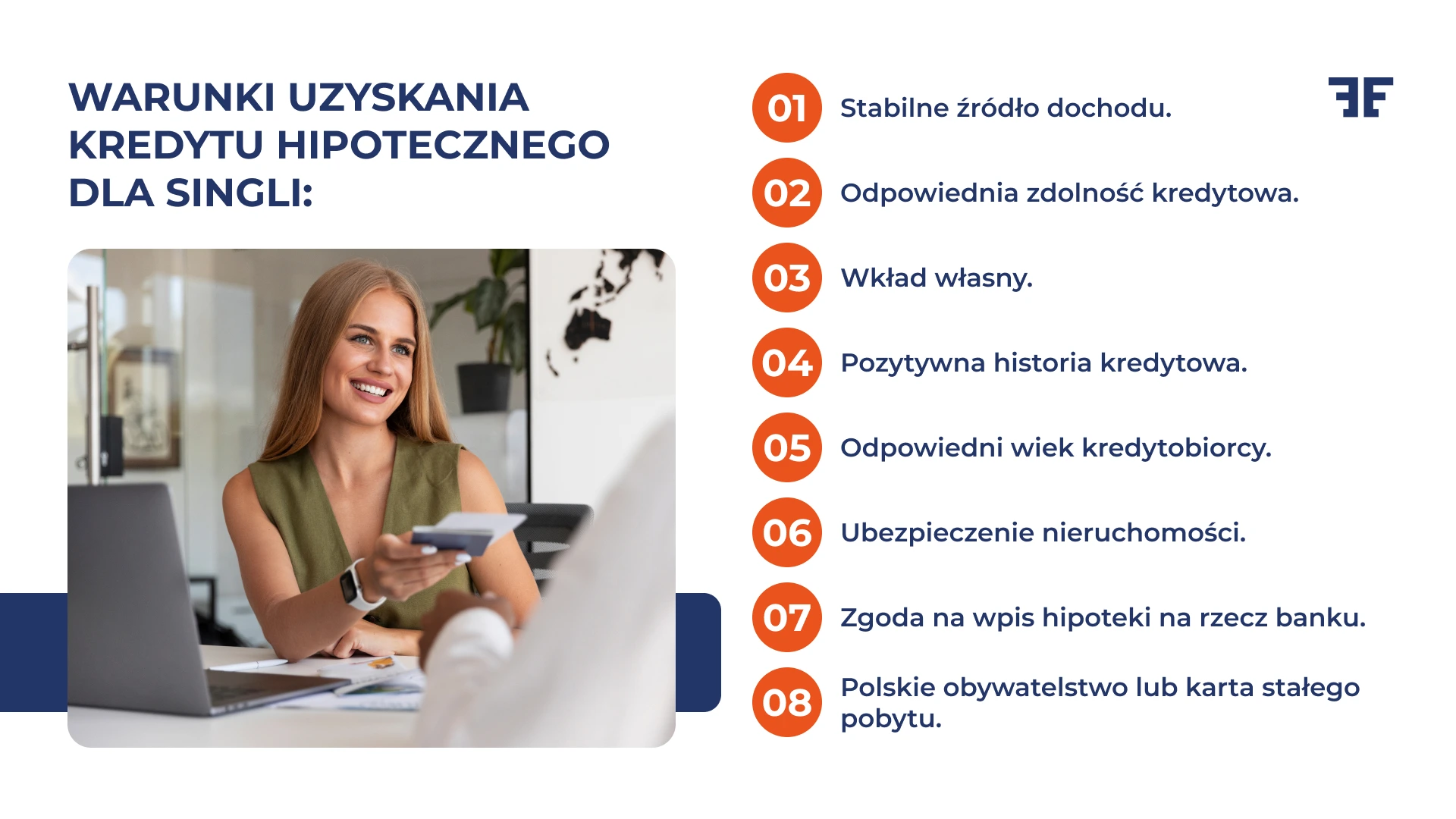

Obtaining a mortgage by a single is possible in the following situations:

- Having a stable source of income.

- Sufficient creditworthiness.

- Gathering the required contribution.

- No negative credit history.

- Meeting the other criteria of the bank in question.

Get a free consultation from Entremise!

Are you lost in the complexities of offers from banking institutions? Or maybe you do not have enough time and patience to fully engage in the analysis of available offers and negotiations with banks? In this case, the most common solution is to work with an experienced mortgage expert.

You can find the best specialists at Entremise! We offer professional support for singles looking for the best mortgage deal. Our experts will help you:

- Analyze your financial situation,

- Assess creditworthiness,

- select the optimal solution,

- Complete the necessary documents and submit an application,

- Negotiate the best terms with the bank.

What sets us apart is our committed approach to each client and our extensive experience in the mortgage market. On our part, we provide you with a personal tutor – an expert in mortgages for singles, who will support you at every stage of taking a loan from the bank.

What to start with? We offer a free consultation where you will speak with one of our representatives. Contact us by phone or through the form available under“Mortgages“.

How is creditworthiness assessed?

Creditworthiness indicates the maximum amount of credit a potential borrower can receive. In your case (single), banks will primarily take into account the amount and stability of income. In this context, the form of employment is important. The information that it is the employment contract for an indefinite period of time that is evaluated most favorably will probably not surprise anyone here. Banks will also analyze your monthly expenses and financial obligations.

Another important factor is the age of the borrower. Younger people are more likely to get a loan for a longer period, which translates into a lower installment. Banks also check credit history in the BIK. The absence of arrears on previous obligations works in favor of the applicant. Having savings and other assets also has a positive effect on the credit score.

Your place of residence also matters. Residents of large cities, where earnings tend to be higher, can expect a more favorable credit score.

Did you know that.

You may encounter banks that also take into account the industry in which the applicant works? There are sectors that are perceived by them as more stable and trustworthy. But keep in mind that each bank uses its own criteria for assessing creditworthiness.

Own contribution vs. mortgage

You already know that the own contribution required for a mortgage is one of the main elements influencing the bank’s decision. Normally, banks expect borrowers to contribute 10-20% of the value of the property from their own funds. The fact is that for a single person this amount can be quite a challenge. If, someone has already started saving systematically for the purchase of real estate some time before, he will have no problems meeting this condition. Others must try to accumulate the required amount in other ways.

Remember that your contribution affects, among other things, how much the loan installment and interest rate will be. In summary, the higher your own contribution, the more favorable loan terms the bank can offer.

This information may come in handy for you!

Did you know that your own contribution does not have to be exclusively cash? Banks also accept other forms, such as the value of a building plot or the cost of construction work already done. Some institutions also offer loans with a lower contribution, but this usually involves additional costs in the form of low contribution insurance.

Housing loan for singles – terms and conditions

Although each bank has its own evaluation criteria, there are some universal requirements that a single must meet in order to increase his chances of getting a home loan.

Mortgage offerings in 2025

In 2025, banks are offering mortgages for singles on various terms. Examples of offers are mortgages:

- With a fixed interest rate in the first years,

- With a low contribution,

- With an extended credit period.

We always recommend keeping up to date with all offers, as the mortgage market is very dynamic and conditions can change quickly. However, efficient comparison and analysis of offers requires commitment, time and analytical skills, so at the very beginning of applying for a mortgage you need to ask yourself a basic question: Are you ready to take on this challenge yourself, or maybe you should consider the support of a financial expert?

A mortgage expert can help you find the best loan deals for singles and negotiate favorable terms. With extensive contacts with many banking institutions, knowledge of current market trends and experience in negotiations, the expert is able to obtain terms often unavailable to an individual client.

Worth knowing!

Banks offer singles different loan amounts depending on the individual situation of the borrower. This can be up to several hundred thousand zlotys of credit. In addition, some financial institutions tempt customers with the possibility of credit for additional costs associated with the purchase of real estate, such as finishing or furnishing the apartment.

What to do before applying for a loan?

Wondering how to properly prepare for this process and all the steps that await you when applying for financing from a bank? We have prepared some valuable tips for you:

- Start by checking your credit history with the BIK and sorting out your arrears, if necessary.

- Estimate your realistic financial capabilities and determine the maximum installment you can pay each month (we encourage you to use the intuitive mortgage installment calculator ).

- Take care to accumulate an adequate equity contribution. Remember that the higher it is, the better loan terms you can get.

- Ensure stability of employment and income.

- Consider additional loan collateral, such as life insurance, which can improve the bank’s offer.

- Before applying, compare the offers of different banks to be sure that you have decided on the most favorable option.

Start working with a financial expert before applying for a loan for singles

The help of a mortgage expert can save you time and money in the long run of loan repayment. We recommend that you start working with an experienced credit expert who will support you in preparing complete documentation, assess your chances of getting a loan and help you choose the best solutions. Professional support increases the likelihood of getting a loan on favorable terms.

A credit expert is knowledgeable about current bank offers and government programs. These comprehensive skills will ensure that you choose the optimal solution. Thanks to their knowledge of banking procedures, this specialist can significantly speed up the process of obtaining a loan. It is worth having the help of an expert at your side, especially when long-term commitments and perhaps the most important decision of your life are at stake.

A mortgage expert deals with:

- Comprehensive analysis of the customer’s financial situation.

- Selecting the most favorable credit offer.

- Preparation and verification of credit documentation.

- Negotiating with banks on behalf of the client.

- Support at every stage of the credit process.

- Help with issues related to additional financial products.

- Monitor the loan process until the contract is finalized.

Want to learn more about the work of mortgage specialists? Be sure to read: How can a financial expert help you manage your finances?

Subsidies and government programs

A single applying for a mortgage can take advantage of various government programs to support the purchase of a first home. Regularly review current information on government programs, as they may change.

“Family Housing Credit”.

Don’t let the name fool you. This loan is also available to single people. The program offers preferential lending terms, including the possibility of obtaining a contribution guarantee from the BGK.

“First apartment.”

Under this program, you can open a housing account with a state bonus. Savings accumulated in such an account can be used as an equity contribution to a mortgage.

You can find information about current government programs to support the purchase of an apartment on official government websites, such as those of the Ministry of Development and Technology or the Bank Gospodarstwa Krajowego. If you have doubts or additional questions, consult a credit expert for singles who keeps up to date with changes in the offer of support programs.

Want to get a loan for singles?

For several years, the mortgage market for singles has been undergoing a visible transformation. Banks have begun to see the potential in this group of customers. They offer them innovative solutions, such as:

- Flexible repayment periods to suit singles’ life plans,

- Loyalty programs that reward job stability and systematic savings,

- The possibility of combining the loan with investments in pension funds.

An innovative approach to mortgages for singles opens up new opportunities and makes the process of buying a property more accessible and tailored to individual needs. Don’t miss your chance to take out a mortgage at favorable terms. Receiving financial support with the help of a credit expert from Entremise increases your chances of getting a favorable offer.

Our expert will help you assess your creditworthiness and choose the best financial solution. He will efficiently and stress-free guide you through the entire process, from preparing the documentation to finalizing the agreement with the bank. He will negotiate for you better credit terms than those available to an individual customer.

A professional from Entremise will take care of your interests and help you avoid the pitfalls hidden in loan agreements. This will allow you to fully focus on choosing your dream apartment, confident that your financial issues are in good hands. In our hands! Feel free to contact us to schedule a free consultation.